What’s Going On Here?

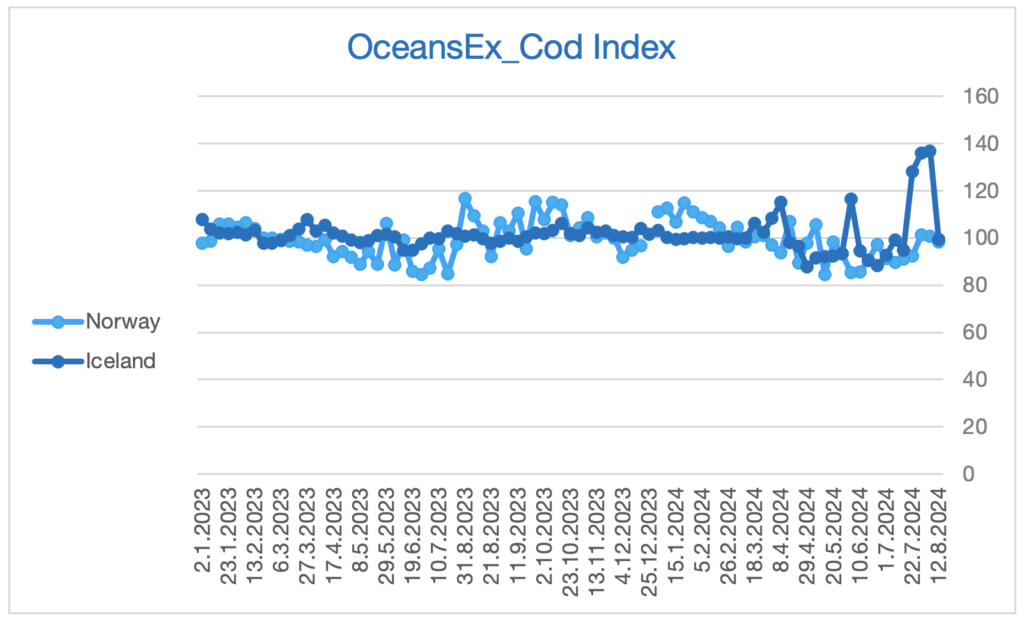

Oceans of Data is excited to present OceansEx , an Auction Index providing fresh insights into the Atlantic cod market in Iceland and Norway. As we approach the new quota year in Iceland, starting on September 1st, 2024, and with the looming prospect of significant quota reductions in 2025—expected to be as high as 30% in the Barents Sea—analysing how the Cod Index has evolved in the first eight months of 2024 is crucial. The Cod Index tracks auction prices for Atlantic cod in Iceland and Norway, revealing critical trends compared to the same period in 2023 and highlighting the economic shifts and market dynamics in these two key supplying markets.

What Does This Mean?

Iceland’s Stabilizing Market:

- OceansEx: The Cod Index for Iceland in 2024 has shown slight improvement, averaging around 101.95, indicating stability with minor growth compared to the previous year. As Iceland enters a new quota year, this suggests a predictable market environment, at least for the short term.

- Price Development: The average price of Atlantic cod in Iceland has fluctuated significantly, with a recent peak at $4.23 per kg in early August 2024. This suggests potential upward pressure as demand stabilizes.

- Inflation YoY: The most significant change is the sharp drop in Inflation YoY, from 30.54% in 2023 to just 3.22% in 2024. This cooling of inflation suggests that the market has adjusted after the sharp price increases observed last year, setting a stable stage for the upcoming quota year.

Norway’s Seasonal Trends and Looming Quota Cuts:

- OceansEx: In Norway, the Cod Index has increased slightly from 97.68 in 2023 to 99.02 in 2024. The data confirms that most cod landings occur in the first four months of the year, reflecting the heavy fishing activity during this period. However, the expected quota cuts in the Barents Sea in 2025 are likely to put significant pressure on the entire market, impacting suppliers not only in Norway but also in Iceland and other regions.

- Price Development: Average prices in Norway have shown consistent growth, with recent highs around $5.09 per kg in March 2024. However, price volatility is expected as quota cuts loom closer, potentially driving prices up further as supply tightens.

- Inflation YoY: Norway’s inflation rate has decreased from 15.36% in 2023 to 12.60% in 2024, but the anticipated quota cuts could reverse this trend by increasing prices as the reduced supply impacts the market.

Broader Market Impact:

The anticipated quota reductions in 2025 will have far-reaching consequences:

- Supply Chain Disruptions: These cuts will affect the availability of Atlantic cod across the board, driving up prices and creating a shortage in the market. Suppliers in Iceland, Norway, and other regions will all face challenges in meeting demand.

- Impact on Substitute Products: As Atlantic cod becomes more limited and expensive, producers of substitute products, such as haddock or pollock, may see increased demand, potentially leading to price hikes in those markets as well.

- Production Impacts: The reduced supply of Atlantic cod will also affect product production, from fillets to processed goods, potentially disrupting the entire value chain. This could lead to increased costs for producers and higher prices for consumers.

Why Should I Care?

- Market Predictability: While the OceansEx and Inflation YoY metrics indicate stabilizing prices in 2024, the expected 2025 quota cuts will introduce significant volatility. For stakeholders, this means a more complex and potentially unpredictable market environment, requiring careful planning and strategic foresight.

- Strategic Adjustments: Understanding the potential impact of these quota cuts is crucial. Businesses may need to secure supplies early, explore alternative sources, or adjust production strategies to limit risks associated with reduced availability and rising prices.

- Long-Term Planning: The coming changes underscore the importance of long-term planning. Whether you’re a supplier, producer, or investor, the quota cuts will have a ripple effect across the entire market, making it essential to stay informed and prepared for these shifts.

Conclusion

The data for 2024 reflects a market moving towards greater stability, with significant reductions in inflation and modest improvements in auction prices. However, the expected 2025 quota cuts in the Barents Sea will have widespread impacts, affecting not just the Atlantic cod market but also related industries and substitute products. To navigate these challenges, staying informed is more important than ever.

Subscribe to our newsletter for ongoing updates, in-depth market analysis, and insights into how industry shifts will impact your business. Stay ahead with Oceans of Data, your trusted partner in seafood market insights.

For weekly updates to the OceansEx or more information on our solutions, contact us at [email protected].