Norwegian salmon exports are a cornerstone of the global seafood industry, with Poland acting as the largest importer and a key processing hub. Beyond direct consumption, Poland’s role in re-exporting salmon products across Europe and beyond makes it vital to the salmon value chain.

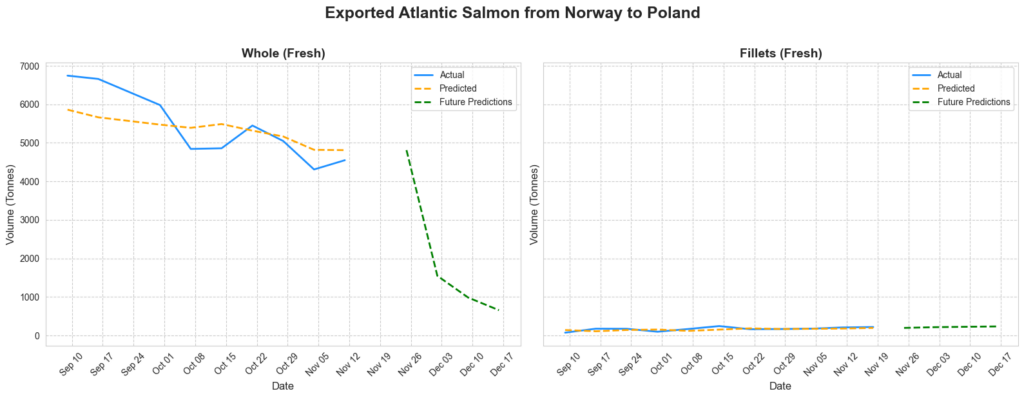

But as we approach the end of 2024, supply trends are shifting. Predictions from OceansofData shed light on what lies ahead for this critical market. Their advanced models provide actionable insights, empowering buyers, suppliers, and competitors to make strategic moves in a volatile market. If you’re not monitoring the trends, you ou could miss opportunities in a quickly changing industry.

What’s Going On Here?

Seasonal Supply Fluctuations

Norway’s salmon harvest and export volumes follow predictable seasonal patterns:

- 2024 Harvest Peak: Monthly harvests peaked at 181,432 tonnes in September before declining to 176,121 tonnes in October and dropping sharply into November and December.

- Current Volumes: Predictions for December 2024 indicate volumes will stabilize around 125,000 tonnes, similar to the December 2023 levels.

Price Trends in 2024

Export prices for fresh whole salmon have mirrored these cycles throughout 2024:

- High Prices in Spring: Prices peaked at $11.93/kg in May 2024, following winter supply shortages.

- Low Prices in Autumn: As harvest volumes surged, prices fell to $7.33/kg in October 2024, the lowest point of the year.

Now, as harvest volumes decline into winter, prices are showing signs of recovery, with November averages edging upward. For Polish buyers and processors, this means rising costs and tighter supply heading into 2025.

What Does This Mean?

For Buyers

Seasonal fluctuations in supply, combined with emerging trade uncertainties like potential import taxes in the United States, a key salmon market- are adding new layers of complexity to procurement. With insights into these trends, buyers can better anticipate shifts in pricing and supply, helping them make informed decisions and reduce risks tied to changing market conditions.

For Suppliers (Norwegian Exporters)

Predictive insights help Norwegian suppliers adapt to evolving market conditions, including potential changes in global trade policies. By monitoring future trends, suppliers can prioritize shipments to critical markets like Poland while preparing to redirect resources in response to geopolitical shifts, such as increased competition or trade barriers in the U.S.

For Processors

Polish processors rely on steady fillet supplies to maintain production and meet demand in their key export markets, like cost increases driven by geopolitical factors, is essential for protecting margins and maintaining export momentum.

For Competitors

Emerging uncertainties, like potential U.S. tariffs on imported seafood, could create openings for competitors to challenge market leaders. Predictive tools can help processors and exporters identify these opportunities and act decisively to capture new market share.

Why Should I Care?

- For Buyers: Predictions help you navigate seasonal shifts and broader uncertainties, ensuring steady supply and protecting against price hikes.

- For Suppliers and Processors: By staying informed and proactive, you can manage risks tied to both market conditions and evolving trade policies.

- For Competitors: With strategic foresight, you can use market shifts, such as new trade barriers, to your advantage and disrupt established players.

Poland’s Role: Processing and Expanding Export Opportunities

Poland’s processing sector thrives on its ability to transform Norwegian salmon into value-added products for export. From January to October 2024, the top destinations for Polish salmon fillets include:

- Germany: 31,822 tonnes

- Italy: 7,912 tonnes

- Denmark: 4,568 tonnes

- Czechia: 4,238 tonnes

- France: 3,541 tonnes

- United States: 3,201 tonnes

Fillets are a key driver of this success, providing flexibility for producing smoked, marinated, or frozen portions. Even as whole salmon exports decline seasonally, the steady availability of fillets ensures that Polish processors can continue meeting demand for convenience-driven seafood products across Europe and beyond.

Impact on Pricing and Profit Margins

Export price trends for whole salmon highlight seasonal volatility, but fillets offer Polish processors greater stability:

- Whole Salmon Prices: Prices fluctuate dramatically, influenced by harvest cycles and logistics.

- Fillet Pricing: Fillets command more stable prices due to consistent demand for value-added products.

For Polish processors, this stability enables them to:

- Mitigate risks of sudden price spikes.

- Maintain steady production of premium products.

- Protect profit margins during periods of whole fish scarcity.

The Big Picture

Poland remains central to the global salmon supply chain, transforming Norwegian imports into high-value products for export across Europe and the United States. Predictions from Oceans of Data make one thing clear: whether you’re a buyer, supplier, or competitor, staying informed is essential to your strategy.

Will you use these insights to secure your position—or risk falling behind?

Final Thought: Stay Ahead with Data

The salmon market is constantly evolving, and staying informed is essential to navigating its challenges and opportunities. Oceans of Data makes this easier than ever. With our comprehensive database and GEN AI solution, ANNA—your Oceans of Data expert—we deliver data and insights in a simple, intuitive manner. These tools empower you to anticipate seasonal trends, manage supply effectively, and maintain a competitive edge.

By acting on these insights, you can position your business for success in a dynamic industry. Be proactive, not reactive—and stay ahead of the competition. Share this story to spark the conversation.