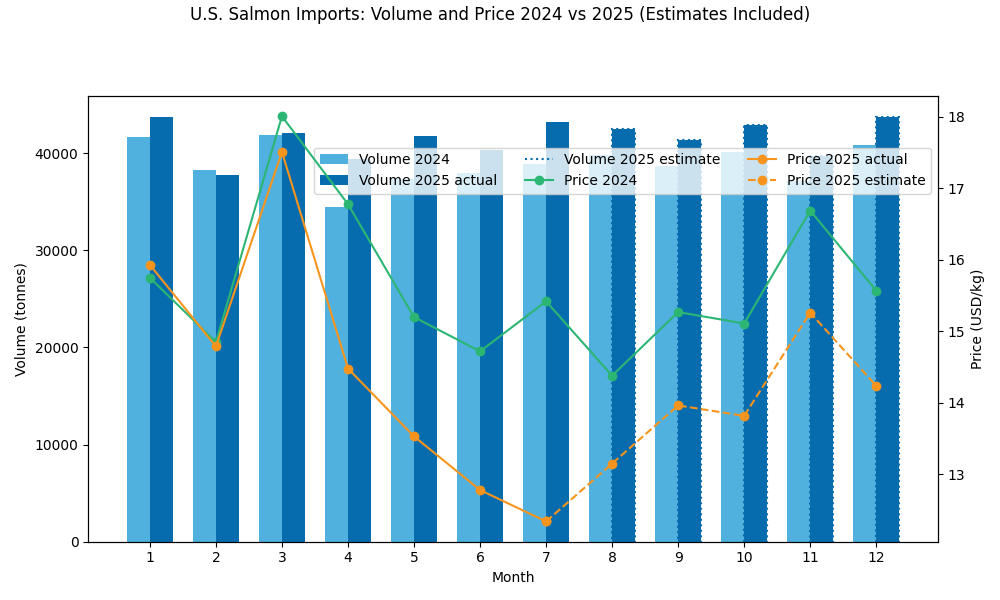

The U.S. imported nearly 288,000 tonnes of salmon in the first seven months of 2025 up 18,000 tonnes from the same period in 2024.

But here’s the catch: The average price per kilo dropped by 8.5% from $15.53 to $14.20 So even as volume grows, exporters are earning less per tonne. In the new tariff environment, pressure on margins is only increasing.

Meanwhile, retail prices have remained relatively stable, which means the squeeze is landing squarely on exporters.

U.S. Salmon Imports Jan–Jul: Volume Up, Price Down A growing supply met with falling prices, a clear signal for strategic timing.

For smaller players like Iceland, this isn’t just a market stat, it’s a window of opportunity.

Sending more fish doesn’t guarantee more margin.

Timing, format, and route now matter as much as volume.

Looking Ahead: Aug–Dec Trade Outlook

Based on historical trends and recent developments (as of October 2025), we expect:

- U.S. imports (Aug–Dec): ~210,000 tonnes

- Average price range: ~$13.60–$13.80/kg

That’s roughly +13,000 tonnes more than the same period in 2024

but with prices still trending ~9% lower year-on-year.

These aren’t forecasts — just signals worth watching as Q4 trade flows take shape.

What’s New in Our API

As trade conditions shift and pricing pressures mount, fast, relevant data is no longer a nice-to-have — it’s a strategic edge.

To help you stay ahead, we’ve refined our API:

- Automated data updates on salmon supply, trade flows, and pricing

- Expanded coverage across key markets and trade routes

- Packaged insights to support planning, pricing strategy, and scenario analysis

Whether you’re reviewing past performance or planning Q4 exports, the API now delivers sharper context, more timely signals, and the tools to act with confidence.

If you’re working through any of these challenges — or just want to see how others are using the data reach out at [email protected]

We’re always happy to walk through what’s possible.

Because you don’t just ship fish.

You shape outcomes.

Team Oceans of Data