What’s Going On Here?

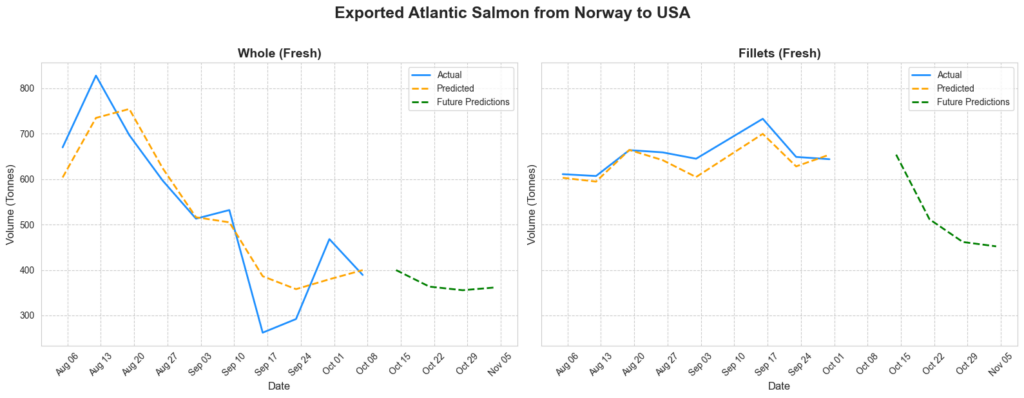

Oceans of Data has updated its salmon export predictions from Norway to the U.S., a key consumer market for salmon. When comparing the first eight months of 2024 to 2023, we’re seeing a consistent downward trend in export volumes from Norway to the U.S. Although certain months in 2024 showed a slight uptick in exports, the general pattern reveals a year-on-year decrease.

The most notable trend is the anticipated sharp drop in salmon export volumes from Norway starting in October. This projected decline aligns with forecasts of reduced supply, potential logistical bottlenecks, and shifting market dynamics. While there was a summer surge in Norwegian salmon exports to the U.S., it is not expected to continue, suggesting that the U.S. market will experience tighter supply from Norway as we approach the end of the year.

What Does This Mean?

The predicted decline in Norwegian salmon exports is likely to create ripple effects across the U.S. market. Several factors could be contributing to this trend, including changing consumer preferences, economic pressures, and potential shifts in sourcing strategies. A closer look at the U.S. product portfolio reveals some interesting insights into how various product categories are performing.

Whole Salmon Holding Strong

Despite the overall decline in salmon imports, U.S. import data shows that fresh whole salmon shipments from all markets have actually increased in 2024, rising from 86,855 tonnes in the first eight months of 2023 to 90,844 tonnes during the same period in 2024. This suggests a growing preference in the U.S. market for whole fish, likely due to the flexibility it offers to local processors, retailers, and restaurants.

Whole salmon is particularly appealing for U.S. businesses, as it can be processed locally into fillets or other value-added products, allowing them to cater to growing consumer demand for fresh, high-quality seafood. This stability in whole salmon imports is noteworthy, indicating that while overall fillet imports may be shrinking, whole fish remains a strong and flexible option for the U.S. market.

Decline in Fresh and Frozen Fillets

In contrast, total U.S. imports of fresh fillets from all markets have dropped significantly, falling from 145,452 tonnes in the first eight months of 2023 to 133,002 tonnes in 2024. This overall decline may reflect changing consumer preferences or broader market dynamics. While the U.S. market has traditionally been driven by convenience and value-added products, the dip in fresh fillet imports could suggest a shift toward local processing of whole fish, which offers greater flexibility and freshness for retailers and restaurants.

Similarly, total U.S. imports of frozen fillets have also declined, from 82,146 tonnes in the first eight months 2023 to 72,646 tonnes in 2024. This reduction in frozen salmon imports could indicate a shift in consumer preference toward fresher options or suggest that buyers are adjusting their sourcing strategies. Meanwhile, imports of frozen whole salmon have increased, possibly reflecting a demand for more affordable, longer-lasting products, as U.S. buyers seek cost-effective solutions in response to shifting market conditions.

What Does This Mean for You?

For salmon farmers, processors, and sales professionals focused on the U.S. market, these export predictions offer valuable insights into shifting demand and supply dynamics, presenting both challenges and opportunities. As Norway remains a key global salmon producer, it plays an important role in shaping market trends, but producers from other regions can also leverage these insights to adapt and benefit. Here’s how these developments—and the export predictions—might impact different players:

- Farmers: The predicted rise in demand for whole salmon in the U.S. presents an opportunity to shift focus toward high-quality whole fish, especially as demand for fillets declines. Understanding these forecasts allows farmers in all major producing regions to carefully manage production, avoiding oversupply and optimizing their harvests for a market that is becoming more competitive and favoring whole fish.

- Processors: With declining demand for imported fillets, processors can use these predictions to adjust their strategies. By forming partnerships with U.S. companies or adapting product offerings, processors can align with the growing U.S. preference for locally processed fish. Export predictions like these can help processors stay ahead by planning for shifts in demand, ensuring they supply whole or semi-processed fish that meet market needs.

- Sales Professionals: Export predictions provide critical foresight into tighter supply and potential price increases, allowing sales teams to fine-tune their pricing strategies and negotiations. Communicating effectively with U.S. buyers about anticipated supply trends, and positioning whole fish as a high-quality, flexible option, will be key to maintaining competitiveness in a dynamic and evolving market.

In Summary

As Oceans of Data predicts a significant decline in Norwegian salmon fillet exports to the U.S. through November 5th, 2024, businesses should prepare for a tighter supply of fresh and frozen fillets. While there is also a decline in whole salmon exports, it is less pronounced, and the continued demand for whole salmon presents an important market opportunity. Norway’s position as the largest global salmon producer means that Norwegian exporters must focus on adapting to the changing landscape, capitalizing on the growing demand for whole fish while addressing the challenges in the fillet and frozen product sectors.

What’s Next?

In our next analysis, we’ll explore how evolving market dynamics may influence U.S. retail prices for salmon. As supply and demand shift—particularly with the anticipated decline in fillets and the continued demand for whole fish—it will be crucial to understand how these changes might affect consumer costs. Stay tuned for deeper insights into pricing trends and how businesses can navigate these developments.

Contact us @[email protected] to see how our predictive solutions can help you stay ahead of the competition.